People turn to cash-back cards for simple rewards that can maximize — and sometimes even offset — their everyday spending. Both American Express and Chase offer an impressive lineup of cash-back credit cards loaded with perks. However, they’re very different and provide unique benefits that make choosing “the best” challenging.

Today, we’ll take a deep dive into Amex and Chase cash cards and see how they stack up against each other.

American Express cash-back cards

The information for the Amex Cash Magnet Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Chase cash-back cards

Related: Why there’s no such thing as the ‘best’ credit card

Comparing Amex vs.Chase cash-back personal cards

| American Express Cash Magnet Card | Blue Cash Preferred Card from American Express | Blue Cash Everyday Card from American Express | Chase Freedom Unlimited | Chase Freedom Flex | |

|---|---|---|---|---|---|

| Welcome offer | $200 statement credit after you spend $2,000 in the first six months | Earn a $250 statement credit after you spend $3,000 in purchases on your new card within the first six months

$0 Buy Now, Pay Later introductory Plan It fees on plans created during the first 12 months from the date of account opening |

Earn a $200 statement credit after you spend $2,000 in purchases on your new card within the first six months of card membership

$0 Buy Now, Pay Later introductory Plan It fees on plans created during the first 15 months from the date of account opening |

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) — up to $300 cash back | $200 bonus after you spend $500 on purchases in the first three months from account opening

|

| Bonus categories | N/A | 6% cash back on purchases at U.S. supermarkets (on up to $6,000 of spending each calendar year, then 1%) and on select U.S. streaming subscriptions

3% on transit and at U.S. gas stations Cash back is received in the form of Reward Dollars that can be redeemed for statement credits Terms apply |

3% cash back on U.S. supermarkets (up to $6,000 per calendar year; then 1%)

3% on U.S. online retail purchases (up to $6,000 per calendar year; then 1%) 3% on gas (up to $6,000 per calendar year; then 1%) Cash back is received in the form of Reward Dollars that can be redeemed for statement credits Terms apply |

5% on travel purchased through Chase Travel℠

3% on dining at restaurants, including takeout and eligible delivery services 3% on drugstore purchases |

5% on up to $1,500 on combined purchases in bonus categories each quarter you activate

5% on travel purchased through Chase Travel 3% on dining at restaurants, including takeout and eligible delivery services 3% on drugstore purchases |

| All other eligible purchases | 1.5% cash back

Terms apply |

1% cash back

Terms apply |

1% cash back

Terms apply |

1.5% cash back | 1% cash back |

| Annual fee | $0 | $0 introductory annual fee, then $95 (see rates and fees) | $0 (see rates and fees) | $0 | $0 |

Comparing Amex and Chase cash-back business cards

sapph

| American Express Blue Business Cash Card | Ink Business Cash Credit Card | Ink Business Unlimited Credit Card | |

|---|---|---|---|

| Welcome offer | Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new card within the first three months

|

$350 cash back after you spend $3,000 on purchases in the first three months of account opening, plus an additional $400 when you spend $6,000 on purchases in the first six months after account opening | $750 cash back after you spend $6,000 on purchases in the first three months of account opening |

| Bonus categories | 2% cash back on all eligible purchases up to $50,000 per calendar year, then 1% | 5% cash back on the first $25,000 spent in combined purchases at office supply stores, on internet, cable and phone services

2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

|

N/A |

| All other eligible purchases | N/A | 1% | 1.5% |

| Annual fee | $0 (see rates and fees) | $0 | $0 |

Which Amex or Chase cash back card is best for personal cards?

The best Amex or Chase card for personal use depends entirely on how you utilize the card’s bonus categories and benefits. You should also keep a close eye on welcome offers, as this is your best chance to rack up quite a bit of cash back from the start.

Best welcome offer for personal cards

At a quick glance, the Chase Freedom Unlimited seems to have the best welcome offer thanks to its elevated bonus-earning of 1.5% extra on all categories. Although this welcome offer can net you up to $300 in cash back, it requires you to spend up to $20,000 while utilizing bonus categories as best as possible. This can be quite challenging for those who do not have high spending habits.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

On the other hand, the Blue Cash Preferred Card from American Express offers a $250 statement credit after you spend $3,000 in purchases on your new card within the first six months. The downside? The card has a $95 annual fee after the first year (see rates and fees), while the other cash back cards have none.

If you want the highest bonus possible for a personal card, go with Amex. Chase cash back cards might be a better fit if you want a no-annual-fee card with a lower spending requirement.

Most rewarding personal cash-back card for spending

Once you’ve earned the welcome bonus, there is only one thing keeping the card in your wallet: recurring earning potential. Both Amex and Chase cash back cards offer generous category bonuses. Choosing the “most rewarding card” is highly subjective, depending solely on your spending habits and preferences.

The Chase Freedom Unlimited offers the most comprehensive suite of category bonuses, with 5% back on travel booked through Chase Travel, 3% cash back on dining (including eligible delivery services) and 3% at drugstores. While the card doesn’t offer bonus cash back at gas stations and grocery stores, the 1.5% regular earning rate makes up for it. Plus, these rewards can be converted to transferable Ultimate Rewards points if you have another credit card that earns these points.

And while the Blue Cash Preferred Card from American Express earns 6% cash back on the first $6,000 spent at U.S. supermarkets per calendar year (1% after that) and select U.S. streaming subscriptions, it carries a $95 annual fee (see rates and fees).

You also could argue that the Chase Freedom Flex offers superior rewards, with 5% cash back on up to $1,500 of quarterly rotating categories when you activate. Plus, you’ll earn 5% cash back on travel booked through Chase Travel and 3% on dining, restaurant and drugstore purchases.

Again, the best option comes down to your spending habits, but Chase cash back cards take the lead when it comes to category bonuses.

Which Amex or Chase cash back card is best for business cards?

When comparing the cash-back business card lineup, Chase offers two cards with higher welcome bonuses than American Express. As a business owner, your spending can vary based on the size of your business and where your business spends money. It’s best to choose a card where you’ll be earning bonus points on your most frequent spending categories.

Best welcome offer for business cards

The Ink Business Cash Credit Card and Ink Business Unlimited Credit Card stand out, as both offer the chance to get up to $750 cash back after meeting their respective spending requirements.

The welcome offer from the American Express Blue Business Cash Card, on the other hand, is lower. With it, you’ll get a $250 statement credit after you spend $3,000 in purchases on your new card within the first three months.

Most rewarding business cash-back card for spending

The American Express Blue Business Cash Card offers the simplest reward structure, while the Ink Business Cash Credit Card offers higher earnings in select categories. Blue Business cardholders earn a flat 2% cash back on the first $50,000 spent on eligible purchases each calendar year (then 1%). It’s ideal for those who don’t want multiple cards in their wallets and remember category bonuses for each one.

For those looking to maximize common business spending categories, the Ink Business Cash is a better card overall. It earns 5% cash back on the first $25,000 spent per account anniversary year at office supply stores and on cellphone, landline, internet and cable TV services (1% after that). You’ll also earn 2% cash back at gas stations and restaurants on the first $25,000 per account anniversary year, which is a nice bonus.

Amex and Chase cater to different customers with their respective cash-back cards. So, consider your spending habits and determine which option is best for you.

Best recurring card perks

Cash-back cards aren’t renowned for their travel perks — however, both Amex and Chase offer unique recurring benefits.

Statement credits

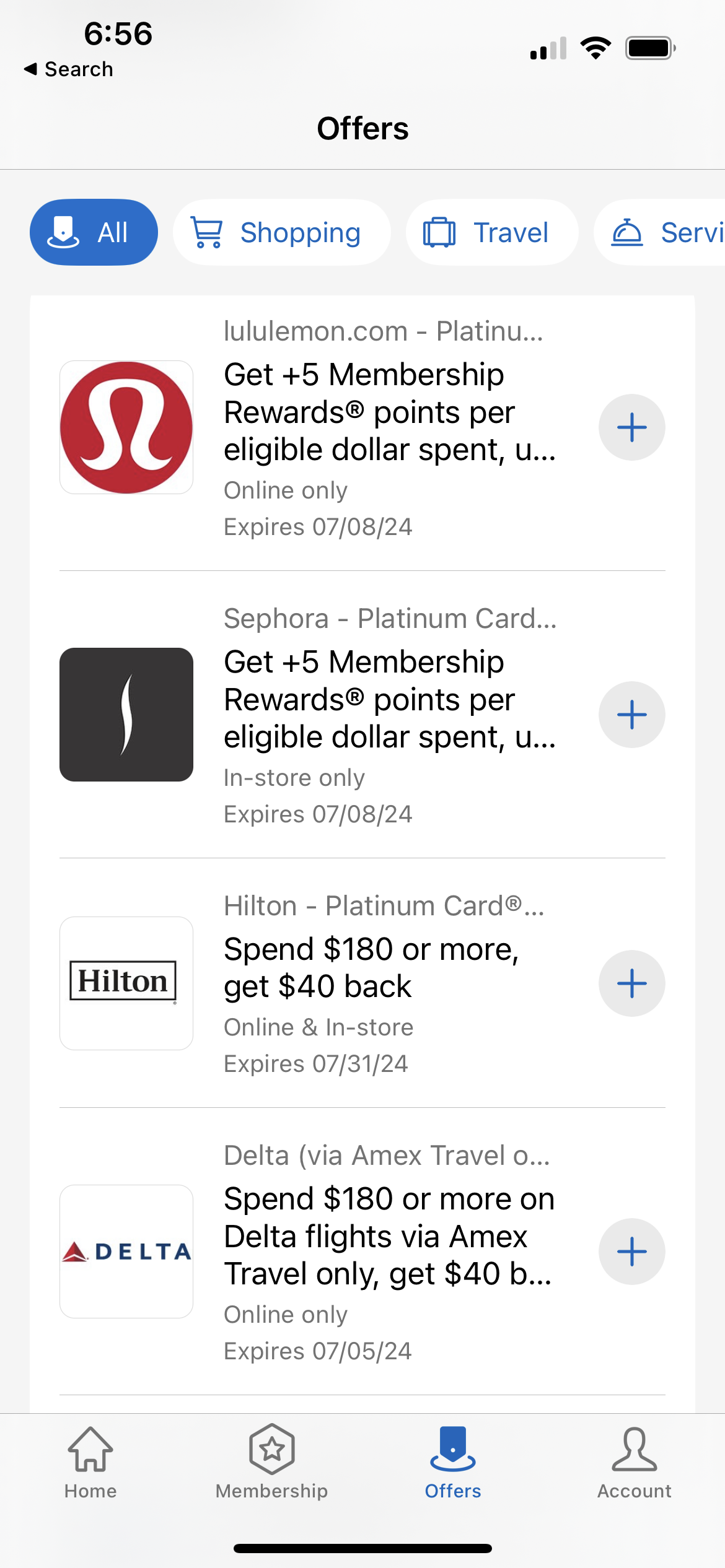

For starters, Amex cash-back cards give you access to Amex Offers, a changing list of deals from popular merchants offering statement credits and bonus points.

Many other banks now offer sync deals but don’t quite measure up to Amex Offers. For example, Chase regularly offers 10% back at popular brands, but they usually come with a maximum of $20 or less. Amex’s higher-value offers make its cash-back card even more valuable.

Shopping

Chase compensates by offering a slew of other perks. Specifically, Chase Freedom Unlimited and Freedom Flex cardholders get three months of complimentary DoorDash DashPass membership, three months of complimentary Instacart+ membership (incl. $10 quarterly statement credits), and 5% cash back on Lyft rides through March 2025.

Depending on your shopping habits, these Chase perks may far outweigh the shopping benefits you’ll get with an Amex card.

Refer-a-friend bonuses

Amex cash-back cards also have an advantage when it comes to refer-a-friend bonuses. Both Amex and Chase banks allow cash-back cardholders to earn bonus points for successful referrals.

The following are bonuses current Chase cardholders can receive if they refer a friend and the application is approved:

| Chase Freedom Unlimited

Chase Freedom Flex |

Ink Business Cash Credit Card

Ink Business Unlimited Credit Card |

|---|---|

| $50 cash back per approval, up to $500 per year | 40,000 bonus points per approval, up to 200,000 |

When it comes to business cards, I utilize refer-a-friend links as an Ink Business Preferred® Credit Card cardholder. In the past 12 months, I’ve earned 80,000 bonus Chase Ultimate Rewards from successful approvals to various Chase Ink cards from friends and family.

Amex offers referral bonuses, but they’re inconsistent and often limited to certain cards. If you’re planning to earn more rewards by referring friends and family to your card, you’ll want to opt for a Chase card.

Flexibility

One significant advantage that Chase cash-back cards have over Amex is flexibility in redeeming rewards. Cash back doesn’t have to be just cash back if you have another Chase card that earns Ultimate Rewards points. You can convert your cash back to Ultimate Rewards points if you also have a card such as the Chase Sapphire Preferred® Card. So those 5% rotating category bonuses from the Chase Freedom Flex can be equivalent to earning 5 Ultimate Rewards points per dollar spent.

This is significant because TPG values Ultimate Rewards points at 2.05 cents each when redeemed for premium awards. So, by taking advantage of this option, you’re essentially doubling the value of your points.

Unfortunately, you can’t convert Amex cash-back rewards to Membership Rewards points, so your Amex cash redemption options are far more limited than what you’ll earn with a Chase cash-back card.

Bottom line

When comparing Amex versus Chase cash-back cards, it’s important to weigh all the different features based on what’s important to you. If you’re after more flexible rewards and referral bonuses, Chase is easily your winner. However, Amex will take the lead if you want more valuable merchant offers. But remember — you don’t have to choose just one. You might decide that a card from each issuer will make the perfect card pairing for your wallet.

Related: The best cash-back credit cards

For rates and fees of the Blue Cash Preferred card, click here.

For rates and fees of the Blue Cash Everyday card, click here.

For rates and fees of the Amex Blue Biz Cash card, click here.